What Compensation Should I Give In My Will to My Personal Representative? Is the Compensation I Give to a Personal Representative Taxable Income for Him or Her?

In Alberta, there is no set amount of compensation or remuneration that must be given to a personal representative or personal representatives to administer an estate after death. In most situations, a personal representative can expect to be reimbursed for any reasonable out-of-pocket expenses, including mileage, associated with administering the estate. In some situations, it may not make sense to designate an additional amount of compensation to a personal representative, such as if one has named a single person both as personal representative of the estate and sole beneficiary of the estate. In some situations, a testator may choose to provide generously to a personal representative if he or she is a non-family member and not a beneficiary of the estate.

The compensation of a personal representative is an important part of a Will to consider thoughtfully. Should a personal representative be inadequately compensated for the work, the court on the application can order that additional compensation be provided out of the estate? Alternatively, residual beneficiaries can agree that an amount of compensation is given to the personal representative over and above what is set out in the will.

Generally, a personal representative’s compensation is taken at the conclusion of the administration of the estate, unless otherwise ordered by the court or allowed in the terms of the will.

In Schedule 1, Part 1, Section 2, the Surrogate Rules of Alberta do set out some factors for the court to consider in determining the adequacy of compensation. These are as follows:

- The gross value of the estate;

- The amount of revenue receipts and disbursements;

- The complexity of the work involved and whether any difficult or unusual questions were raised;

- The amount of skill, labour, responsibility, technological support and specialized knowledge required;

- The time expended;

- The number and complexity of tasks delegated to others; and

- The number of personal representatives appointed in the will, if any.

Further, additional compensation can be allowed by the court in situations in which the personal representative is performing additional tasks apart from the role of administrator of the estate, encountering unusual circumstances, or instructing on litigation (Surrogate Rules, Schedule 1, Part 1, Section 3).

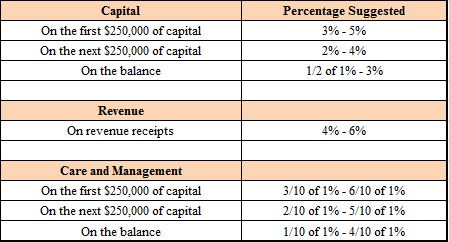

The Legal Education Society of Alberta and Law Reform Institute have suggested Guidelines for the range of executor’s fees. These guidelines are not binding on the court. However, they have been used regularly by the court, as compared with the factors set out in the Surrogate Rules, to assist the court in coming up with fair remuneration for personal representatives. (see for example Sklar, Re, 2010 ABQB 544 and Chabros v. Anderson, 2011 ABQB 806, and more recently, Brimble v. Pullen, 2016 ABQB 421).

The Guidelines suggest as follows:

The calculations above are based on factors unknown to the testator at the time the testator executes a will. However, the testator should have a good idea of the size and complexity of his or her estate at the time of execution of the will, and such knowledge should inform the level of compensation. Often, at Quantz Law we suggest that the testator consider designating a payment between 3% and 5% of the gross aggregate value of the estate, which amount is to be divided between or amongst the named personal representatives if more than one. A carefully thought out payment to a personal representative might decrease the risk of a court application by a personal representative who has not been compensated adequately.

Are the fees I give to a personal representative taxable income for him or her?

Yes, the fees designated to a personal representative are earnings and are taxable in the year the fees are paid. However, whether the fees are considered employment income or business income is dependent on how the duties were carried out. If employment income, the estate should issue a T4 to the executor and remit the withholding tax to the Receiver General.

What if a testator provided the compensation by way of a gift? If the “gift” was for work conducted on the estate, the CRA can look behind the intention of the gift and rule that it is taxable income. If the “gift” is truly a gift, the personal representative can make an application to the court for adequate remuneration, since remuneration was not provided to him or her by way of the Will.

Should you be earning income as a personal representative, please discuss your reporting obligations to Canada Revenue with an accountant or a tax lawyer.

Paula Kinoshita

NOTICE TO READER: The summaries of legal rights and remedies described above are general references to the Alberta laws existing at the date of the publication and may not apply to the reader’s individual circumstances. Also, the laws may change. These legal summaries are not to be relied upon as applicable to your individual circumstances and are subject to a complete review of the facts and applicable laws in every case.

What is a Joint Tenancy in regard to land? How can it be severed? Can it be severed by a Will?

FAQ about Wills, Enduring Powers of Attorney, and Personal Directives